Introduction

The Covid-19 pandemic has resulted in an unprecedented global economic landscape that is dominated by loose monetary policies, low borrowing costs and influx of capital in the equity markets. Against that backdrop, Mergers and Acquisitions (M&A) activity has surged since 2021 as companies are trying to take advantage of the current environment and adapt to the new business realities shaped by the global pandemic. As an example, low loan growth expectations and margin compression on fee income segments will fuel further consolidation in the US retail banking sector.

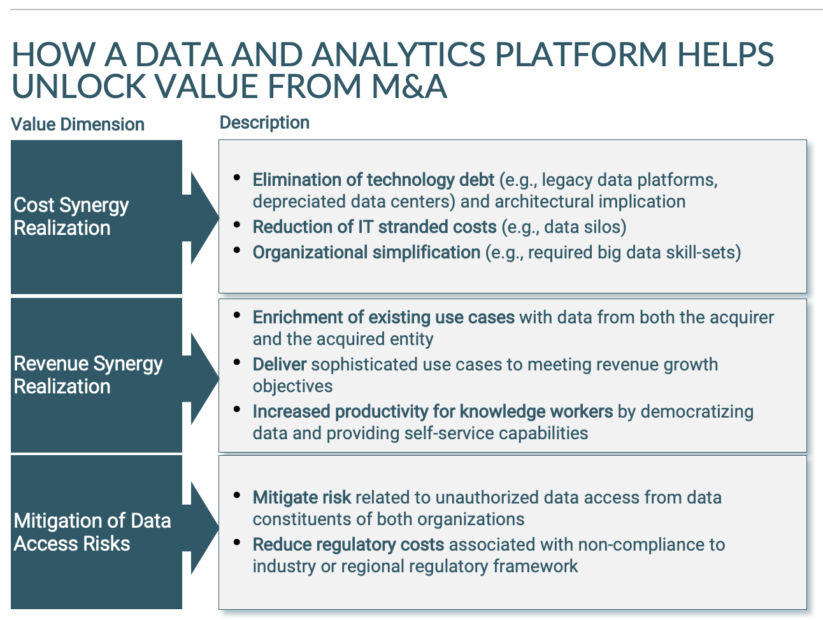

Within that context, technology modernization will become a key prerequisite for unlocking value in M&A settings. Given the significant role that IT plays in value capture from inorganic growth strategies, it is imperative for impacted organizations to rethink their technology strategy, particularly for advanced analytics, that play an increasingly dominant role in business model differentiation and revenue growth across industries.

The intent of this two-part article series is to articulate the value proposition of Cloudera Data Platform (CDP) as an inorganic growth enabler in different M&A settings such as corporate carve-outs, mergers and acquisitions. This first article covers the benefits of Cloudera Data Platform for the integrating entities in Mergers and Acquisitions scenarios and the second article addresses Asset Divestitures / Carve-outs.

Technology Challenges in Mergers and Acquisitions

The integration of technology is one of the most important priorities for the corporate entities involved in a merger or acquisition (for example, according to McKinsey and Company, 50-60% of integration initiatives intended to capture synergies are strongly related to IT). Many times, organizations delay or even fail to realize the expected revenue and cost synergies from an M&A transaction due to inefficient integration approaches that result in heterogeneous, disparate technology stacks and IT stranded costs. Examples of those challenges for data and analytics platforms include:

- Limited cost synergies: Increased costs due to lack of integration between data and analytics solutions used by the combining organizations. That technology fragmentation introduces greater architectural complexity, increased maintenance and operational costs (e.g., different skill sets required to build solutions in multiple analytical processing frameworks),IT stranded costs related to data silos that existed before or were created as a result of the integration and, finally, redundant, underutilized infrastructure;

- Unrealized revenue synergies: Failure to integrate data silos of the acquired entity into the buyer’s data ecosystem will hinder revenue synergy realization from new use cases that depend on blending data between the two organizations for better correlations and richer insights;

- Data access risks: Having multiple data environments with different security and governance models increases regulatory risk (due to the greater effort required to ensure enterprise-wide compliance) and, as a result, impedes data democratization;

Required Capabilities for a Data and Analytics Platform to Realize Value from M&A

To address the challenges listed above and help realize value from M&A, a ata and analytics platform needs to:

- Enable cost synergies by integrating analytical use cases of both organizations and by retiring technical debt. That technical debt includes silo-ed data warehousing appliances, homegrown tools for data processing, or point solutions used for dedicated workloads such as machine learning. To address that need, the data and analytics platform needs to provide pre-integrated, interoperable processing capabilities across the data lifecycle (e.g., data engineering, data warehousing etc.);

- Enable revenue synergies by providing a comprehensive and multi-functional analytical environment that is capable of complex use cases to help realize the revenue growth objectives of the combined entity. In addition, the data platform should enable blending of data from both entities regardless of type or frequency to enrich existing and new applications;

- Mitigate data access and regulatory risks by offering a robust and economical way to secure data access, particularly in industries such as banking with a complex, extensive and continuously evolving regulatory framework and compliance requirements;

How CDP adds value in Mergers and Acquisitions

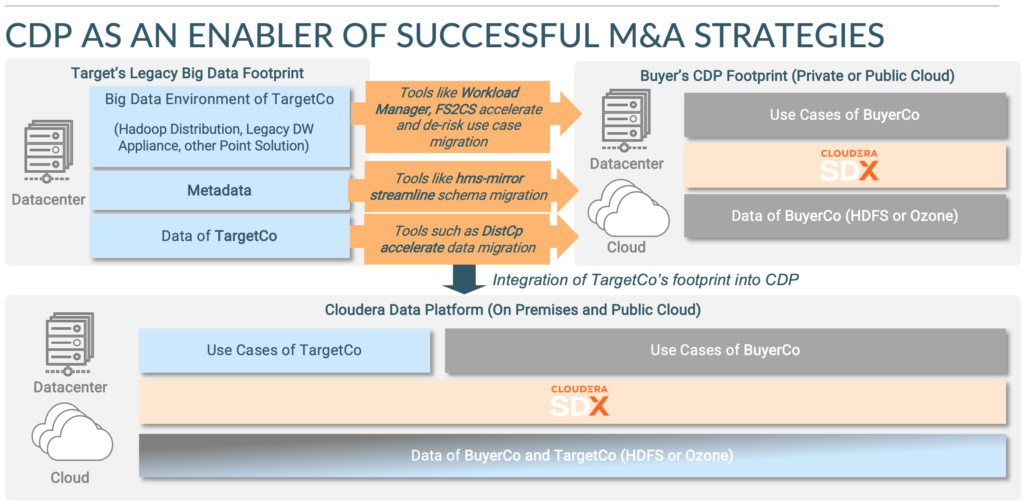

To address the aforementioned challenges, the ideal data and analytics platform needs to meet both the existing and future analytical requirements of the integrating entities, acting as the foundational data infrastructure to enable data-driven use cases, applications and products. However, most data and analytics platforms can only address a narrow scope of analytical use cases and requirements. For example, cloud-only data platforms cannot satisfy regional data sovereignty requirements. Other platforms have been architected for a specific type of use case (e.g., data warehousing) or are based on a single processing framework (e.g., Apache Spark). That approach ultimately limits the types of use cases that can be implemented. Unlike those data and analytics platforms, Cloudera Data Platform is the ideal Enterprise Data Platform in M&A scenarios due to its hybrid portability, lifecycle analytical capabilities and interoperability. More specifically, it can deliver the following benefits in an M&A setting:

Realize Cost Synergies:

- Simplify the data infrastructure stack across the Edge2AI data lifecycle: Being the only comprehensive Enterprise Data Cloud for advanced analytics, CDP provides a single platform to implement any use case for data stored anywhere – data centers, public clouds or at the Edge. As a result, the two integrating entities don’t need to retain disparate solutions and can reduce architectural complexity, data silos and associated IT overhead costs by leveraging a single multifunction platform;

- Accelerate cost synergies with industrialized migration capabilities: Cloudera has contributed to and developed dedicated processes and tools (such as DistCp, hms-mirror) and established technology partnerships (e.g., orchestrated data warehouse offloads with Gluent) that enable successful migration of workloads that previously ran on legacy data platforms or older Hadoop-based distributions. As a result, it accelerates technology consolidation and helps retire big data technology debt;

- Streamline infrastructure and data processing costs with a hybrid, multi-cloud deployment model: CDP supports all possible deployment models (on-premises / private, hybrid and multi-cloud). As a result, the combined entity can optimize infrastructure costs for the new use cases by optimally allocating workloads to the most cost effective hosting environment leveraging insights from Workload Manager;

Realize Revenue Synergies:

- Enhance revenue-generating initiatives by enabling blending of any type of data in different operational or analytical capabilities to achieve different business outcomes, not previously possible with existing solutions due to their narrow analytical capabilities;

- Enable innovative business models (such as data product commercialization) by leveraging a comprehensive Enterprise Data Cloud that meets all functional and nonfunctional requirements for transactional or analytical processing to capture white space opportunities;

- Improve strategic decision making by enabling all foundational capabilities for data democratization (e.g., data security, governance, discovery and visualization) with features such as CDP Data Catalog and Data Visualization;

Mitigate Risk:

- Reduce data access risks with Shared Data Experience (SDX): With SDX, organizations can apply a consistent security and governance framework to all data assets regardless of where that data resides. That capability reduces the operational effort to make data available to different analytics and data constituents within or outside the organization;

Conclusion

As described above, Cloudera Data Platform can serve as a foundational data infrastructure to address IT-related M&A challenges and accelerate value capture.

In that context, CDP will serve as a comprehensive, advanced analytics environment, capable of hosting all advanced analytics workloads from both the integrating entities and reduce risk as well as enable realization of cost and revenue synergies:

To learn more about the Cloudera Data Platform, visit https://www.cloudera.com/products/cloudera-data-platform.html