I recently had the privilege of attending the CDAO event in Boston hosted by Corinium. Tracks represented financial services, insurance, retail and consumer packaged goods, and healthcare. Overall, it struck me that while data science is not new, most firms are still defining the mission of the data office and data officer. It’s clear firms seek to leverage data and embrace its potential insights, but most are forging ahead in largely uncharted territory. Successes are real, but getting there takes creativity and fortitude.

Storytelling

A common theme that was highlighted continuously was using “storytelling” to relay the value that data and analytics teams bring to the business. There is a clear consensus that data teams should express their goals and results in business value terms and not in technical, tactical descriptions, such as “improving data engineering” and “better master data management.”

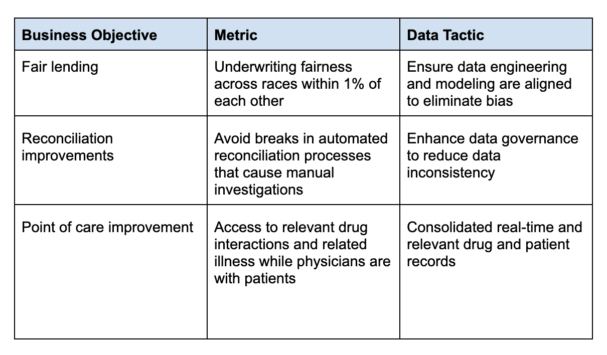

In order to articulate business value, start by identifying the business questions that need to be answered in collaboration with the line of business. From there you will have guidance on what the business needs, as well as direction on the right data to source to help identify the answers. Some examples provided across the financial services and insurance sessions included:

Related to the focus on business impacts were discussions on how to measure the value enabled by the data office. There were several approaches on potential metrics including:

- Value to the end client: simplicity, more value, speed of availability

- Revenue: increased revenue, greater client adoption, increased pipeline of products

- Cost Savings: costs avoided, manual labor and time savings

A key point of emphasis around metrics was focused on agreeing on the target metrics with business partners. Let them help you articulate the measurable benefits to the business. Following on to this point, it was also emphasized to use measurable results to justify budgets for future projects (not a novel idea, but one that reinforces fundamentals).

Are you playing offense or defense?

This leads to a further challenge of the chief data and analytics officer’s role: Is the mission to play offense—drive revenue? Or play defense—manage risk for the organization? The speakers at the summit indicated that they are primarily asked to play defense. A large component of their role is data management related to regulatory compliance. Privacy, security of the data, access, and rules around data usage and managing correlated risks prevail. The exponential increase in the amount of data to be managed and the expectations to better leverage it drives this focus. The insurers and financial services providers emphasized the many siloed systems within their long-standing organizations could keep them endlessly in this defensive role. Yet if their only purpose is secure data storage, they know the market will leave them behind.

As a result the more offensive, revenue-driving goals are top of mind. There were many different tactics shared on how to balance both. In one institution, the expansion of the data team to include analytics brought more purpose to the data. They have developed a data and analytics team centered around customer types to more specifically understand the needs of those customers. In another firm, the head of the data office also owns the digital channels. This direct correlation in responsibility enables the insight from the data to have a business outlet specifically aligned to results. This was very compelling as the digital channel team is continuously receiving the benefits of the data and providing a built-in feedback loop for improvements.

One example of regulatory reporting that flipped from defense to offense was also particularly innovative. It was illustrated that the compliance report that does not have the underlying data corrected at the source yields the same problem in various team’s reports. If that data is corrected within each individual team, the cost is 20x manual corrections based on the same inconsistency. Fixed centrally, the cost savings is flipped to improve margins.

“Is the mission of the CDAO to play offense—drive revenue? Or play defense—manage risk for the organization?”

Change agents

Finally, another term that was repeatedly used was that the CDAO must be a change agent. While there is a real benefit in more extensively using data and AI, it is not easy to convey this value against the way the industry has been doing things forever. As an example, specialty insurance underwriting was highlighted. The logic used by a senior underwriter was replicated to streamline the initial underwriting screening, and then turn over the unique, manual assessment. This was initially met with much resistance until proven effective and repeatable to accelerate the process.

The CDAOs spoke positively about this role of change management. They realize a lot of freedom to define and shape their role in their companies. And while effecting change is very challenging, all were eager to make strides in the acceptance of a data-driven culture while impacting the bottom line. Cloudera has written an ebook together with Corinium on the success factors for CDAOs. This includes further insight from data executives on the topic of change management. They speak to the same critical topics of success addressed at this event—avoid getting mired in the technical details, drive forward with business goals, and seek ways to demystify what happens in the data office. Thank you to all the speakers at this fantastic event for sharing their experiences.

Cloudera provides a hybrid data platform that helps accelerate the use of data to drive informed decision making and measurable impacts for the business. Read more about our success stories.