Data has become an essential driver for new monetization initiatives in the financial services industry. With the vast amount of data collected from customers, transactions, and market movements, among other sources, this abundance offers tremendous potential for financial institutions to extract valuable insights that can inform business decisions, improve customer service, and create new revenue streams. With the emergence of new technologies, including privacy enhancing techniques (PETs) that further protect the customer, monetizing data has become more accessible than ever before.

Considering today’s mobile-first-, mobile-almost-everything world, there has been a surge in the use of mobile banking applications, only accelerated by the COVID-19 pandemic. With more people relying on mobile digital transactions to check balances, make deposits and payments, and execute trades, financial services firms are able to collect a massive amount of data on a wide range of customer behavior. These data and other sources represent key opportunities for data monetization. By leveraging these data and creating a data-driven culture, firms can generate new revenue streams and improve their operations.

Third party opportunities

One way for financial services firms to monetize their data is by selling it to third parties.

Here are some relevant examples from across the industry:

- Retail banks can sell their customer transaction data to marketing firms that are interested in understanding consumer behavior.

- Commercial banks can also sell data on business transactions and credit history to credit rating agencies and other financial institutions.

- Wealth managers can monetize their data by selling analytics and insights to their clients, such as customized investment recommendations based on an individual’s financial goals and risk profile.

- Asset and fund managers can sell data and analytics to their clients, such as performance data on different investment portfolios.

- Stock exchanges can monetize their data by selling real-time market data to financial institutions and news organizations interested in tracking market trends and movements.

- Central banks can sell data on economic indicators and monetary policy to financial institutions and researchers.

Developing new products and services

In addition to selling data, financial services firms can also monetize their data by using it to create new products and services. Customer 360 initiatives enable hyper-personalization to target the right customer with the next best action, which leads to more engaged customers and better outcomes from data monetization.

For example, a retail bank can use customer transaction data to develop personalized financial products, such as credit cards and investment portfolios, tailored to individual needs. Investment banks can use data on market trends and investor behavior to create new financial products and services, such as derivatives and structured finance products.

Factoring in compliance

However, protecting customer data and adhering to data privacy laws is critical for financial services firms. The phrase “with great power comes great responsibility” comes to mind. In order to monetize their data while still respecting the privacy of their customers, these firms must implement robust data protection measures and adhere to relevant regulations. This includes implementing strong security measures, such as encryption and multi-factor authentication, and only collecting and using data with customer consent.

Financial services firms must also carefully consider how they share data with third parties, entering into data sharing agreements that outline the terms and conditions for data use. In addition, they must comply with relevant data privacy laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), and be transparent about their data protection practices.

Shifting to a data-driven culture

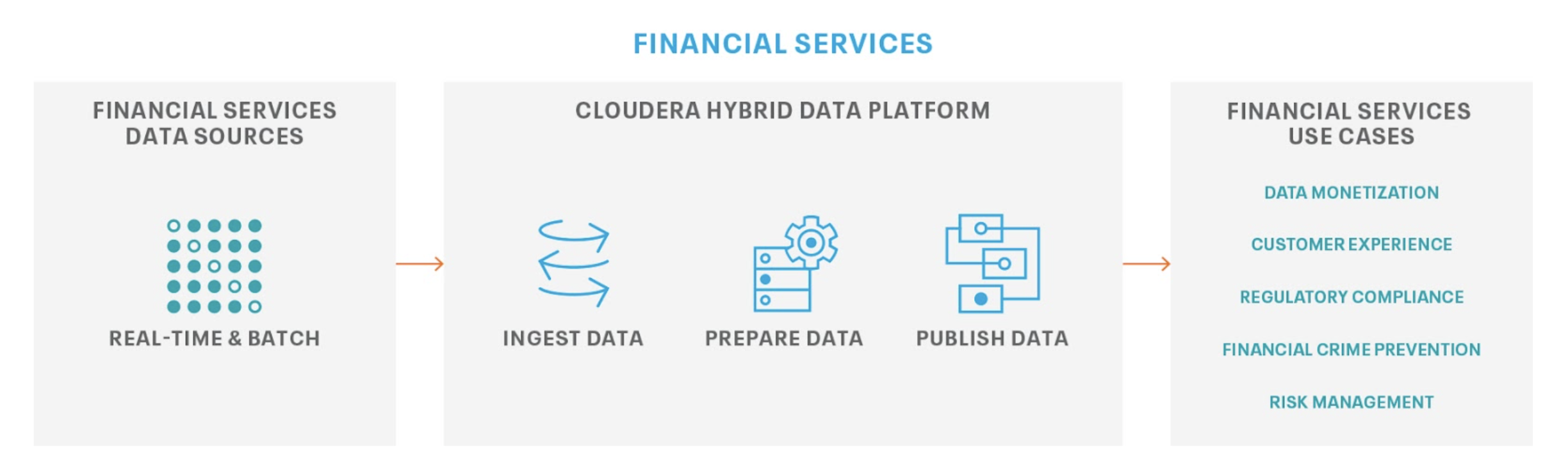

To fully realize the value of their data, financial services firms must create a data-driven culture that prioritizes the use of data in decision-making and innovation. This includes investing in modern data architecture, such as using a platform like Cloudera, which enables companies like Santander UK to store, process, and analyze large amounts of data in real time. By using data to inform their strategies and operations, financial services firms can better understand their customers, improve their risk management, and identify new opportunities for growth.

Overall, there are many ways for financial services firms to monetize their data, including selling it to third parties and using it to create new products and services. By adopting a data-driven culture and investing in modern data architecture, these firms can better leverage their data to drive innovation and generate new revenue streams while also protecting the privacy of their customers.

Learn how financial services firms are leveraging Cloudera for data-driven use cases from customer retention and profitability to reducing fraud and risk exposure.