Risk management is a highly dynamic discipline these days. Stress testing is a particular area that has become even more important throughout the pandemic. Stress tests conducted by authorities such as the Federal Reserve Bank in the US are designed to keenly monitor the financial stability of the banking sector, especially during economic downturns such as those brought on by the pandemic. Similarly, the European Central Bank is issuing stress testing requirements related to climate risk given the potential economic shifts related to addressing climate change. As part of these tests, the resiliency of institutions is modeled using hypothetical scenarios. These scenarios create a powerful view of potential outcomes based on variable inputs.

Simudyne, a Cloudera partner, provides software that makes it easy for institutions to create the models and run the simulations and scenarios they need to better predict and anticipate events including economic and market events. Simudyne uses an approach called Agent-based Modeling (ABM) that is robust and flexible. Financial institutions use it to analyze scenarios, solve complex problems, forecast and make better decisions. I’ve been working closely with Simudyne for a while now and find their offering incredibly relevant to the types of issues I hear from our customers. In this post, I’ve interviewed Justin Lyon, CEO of Simudyne, to explain more about agent-based modeling and how it is used.

What is Agent-based Modeling?

Justin: Agent-based Models (ABMs) are computer models for simulating the actions and interactions of autonomous elements (such as organizations, groups, or individual people). It is widely used in science to search for explanatory insight into the collective future behavior of elements who obey (or may disobey) rules. Each element (or agent) is an entity which may be modified to assess its resulting impact on a complex system, such as a financial market or the planet’s climate. These individual elements might include temperature, coal powered energy facilities, emission rates, barometric pressure, sea level, etc. When modeled and run in a simulation, the interaction of the agents helps us to better understand potential outcomes for not only the agents and groups of agents but for the whole system.

How is this different than other modeling tools?

Justin Lyon: Financial markets have experienced sudden and largely unforeseen transitions from normality to chaos. Market participants respond in widely varying ways to the arrival of new information as transitions occur, often across an entire system. In general, traditional models have universally failed to predict unusual behavior over the last century. It has been argued that phase transitions may have emerged as responses to unpredictable events.

In addition, Monte Carlo simulations only capture part of the solution. Monte Carlo models are unable to deal with non-uniform behavior within financial systems because Monte Carlo simulations typically rely on a single, amorphous, representative agent, thereby missing the fundamental insights provided by agent-based models that incorporate heterogeneous behavior.

Post-mortem analysis has, however, often revealed that in addition to unanticipated phase transitions, there were also endogenous underlying processes which were both major causes and contributors to such apparently chaotic and emergent behavior. Analyses of the complex systems that make up the fabric of critical social infrastructures in financial markets, climate and ecosystems reveal that, before a major transition, there is often a gradual and unnoticed loss of resilience. This makes systems brittle, such that a small disruption can trigger a domino effect that propagates through entire systems, tipping some or all of a system into a crisis state.

Who is using your solution?

Justin Lyon: Our customers include entities that are eager to advance their modeling to create scenarios with greater flexibility. They can vary the inputs and assess the impact across a wide range of tests. We work with modeling and simulation teams at firms including the London Stock Exchange Group, Mastercard, Barclays and the UK Government.

You now have an SDK. How does this work?

Justin Lyon: Our Software Development Kit helps users to build models and run simulations that have the complexity and realism of the real world. Models built with Simudyne are useful for production level simulations. The SDK can build both granular and general concepts into its models, unifying macro and micro modeling.

The Simudyne SDK can model a wide variety of situations and concepts, including the increase of complexity over time, the emergence of new entities, the way a system responds to feedback, and the process of contagion. The modeling core is the backbone of the Simudyne SDK. It is a collection of libraries which emphasizes speed and processing power in building highly flexible models. Models built with the core are also engineered to be easily maintainable.

The SDK is available for trial at https://docs.simudyne.com/overview/access.

Simudyne and Cloudera

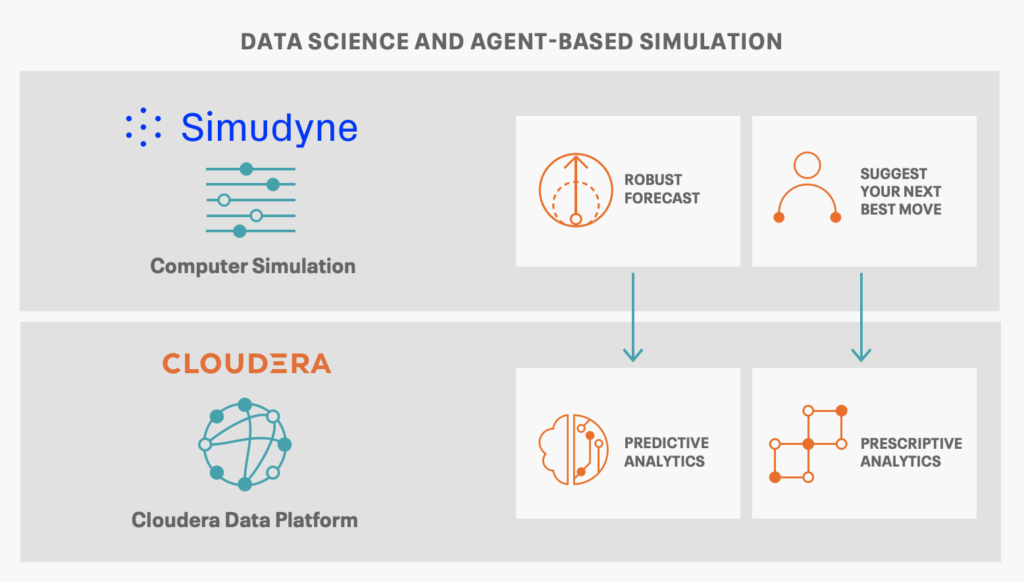

Cloudera and Simudyne have partnered to bring this suite of advanced computation simulation capabilities to financial services firms. The Simudyne solution is certified on Cloudera Data Platform to leverage your existing data and analytics platform.

Some of the sample use cases that are improved by ABM include:

- Balance Sheet & P&L Forecasting

- Simulating Credit Risk

- Climate Risk Management

- Simulating Equity Markets

- Mortgage Market simulations

- Central Clearing Party Model

- Portfolio Management

To learn more about how the solution can help you create high fidelity models of complex financial markets and to better manage stress testing and the creation of scenarios, download our Simudyne partner brief. To watch how ABM enables better decision-making, view this Simudyne webinar.