Like many other people, I used time over the recent holidays to clean out and organize my digital files. In that process, I finally trashed the speaking notes for a panel I participated in at SMA’s (Strategy Meets Action) first summit in 2012 when I worked at a large global insurer. During that session, a gentleman in the audience asked me what I thought about “big data” and its implications for Insurance. Back then, my answer to him was that I had zero thoughts about big data, small data, or medium data for that matter. My sole focus was on understanding my customers, their assets, relationships, requirements, risks, and exposures. As long as our technology partners could help me with those issues, I couldn’t care less about big, small, medium or whatever size data.

We then had a long discussion on if and how big data could contribute to better understanding of our customers and the potential impact of new technologies such as Hadoop. We complained about old fashioned spreadsheets and pondered esoteric options such as voice analytics, drone risk assessments, and predictive fraud analytics. We concluded that this was all very interesting and somewhat promising, but only feasible FAR, FAR away in the future. The people that argued this will happen soon, such as my visionary friend and recognized InsurTech Top 50 Influencer for Insurance Denise Garth, were, in all honesty, not always taken very seriously.

Big Data adoption surprised many of us

Fast forward to today, only about eight years later, I couldn’t help but chuckle as I was reviewing Cloudera’s most recent industry infographic on how data and analytics are transforming insurance.

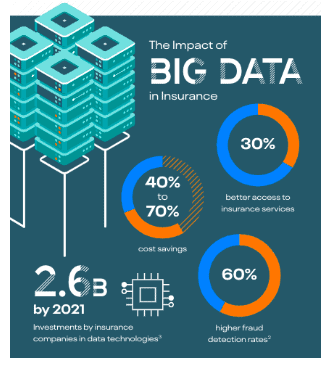

Our latest infographic titled Transforming Insurance with Data, outlines some of the biggest impacts big data and analytics is having on the Insurance vertical. These include measurable positive business impacts such as a 40-70% improvement in cost savings through operational efficiencies and about 60% improvement in fraud detection rates.

The infographic also highlights how some of the leading Insurance providers across the world, such as Zurich Insurance, are driving value out of data and realizing business benefits. We are also starting to see the first phase of investments in AI and machine learning paying off, primarily in the areas around policy administration, claims management and processing. Most, if not all, of the data related technologies we discussed in 2012 are rapidly becoming operationalized in core systems and data management environments. Furthermore, we are starting to view them as “normal” and not so cutting edge anymore.

To learn more, download the Insurance Infographic here

What Lies Ahead for Insurers

With this experience, we are now looking forward to the next leap of great innovations. And I think we can all look forward to a very exciting decade ahead. If I go out on a limb here I would predict over the next few years we will see the wider adoption of an enterprise data cloud environment, which can manage any data, from any source, anywhere with best-in-class security, governance, and compliance. This will enable insurers to truly utilize any type of data such as streaming video from connected cars for underwriting and claims management related to car accidents and weather-related events. I also predict massive IoT/sensor adoption in health management and insurance. For example, IoT will be used to better monitor and manage diabetes including sensors for movement and diet, caps on teeth for food analysis, etc. In commercial insurance, sensors could be used for tracking safe movement and locations, predictive maintenance planning and in support of fraud prevention (sensors on assets and video/sensors to validate services delivered). And less sexy but really very exciting, I predict that we will finally crack how to analyze and use the vast amounts of unstructured text data every insurer stores in a simpler and faster way.

Having said this, as 2012 showed, I have been wrong before in my predictions. I tend to be conservative in estimating the adoption of new technology (I am an insurer at heart after all). But maybe my recent years in technology have calibrated my time estimates. Time, and possibly Denise, will tell.

Whatever happens in this next decade in data management though will be exciting, and it will keep rapidly transforming our insurance industry. I am sure such an insurance infographic will look very different in 2025 and again in 2030 than it does today. Who knows? Robots, climate change mitigation, and claims, 3D body parts in health care, chips in people for ID and health records. One this is for certain, there will be exciting times ahead!!

For more information on how data and analytics are reshaping Insurance, please visit: https://www.cloudera.com/solutions/insurance.html

2012 seems like eons ago… as you say it is exciting to be in insurance today – there are so many innovative activities underway… one thing I find interesting is that back in 2012 there were not that many insurers that wanted to think past 2-3 years for strategy. Today we are regularly having conversations and doing workshops on Insurance 2030… what our business will look like 10 years out and what should be started now to prepare for that…. and as far as big data/analytics/AI…. I believe those technologies will be pervasive and play a dominant role in insurance

This is the good insurance company they are using new technologi